Exness Trading

Legal Status of Exness in Pakistan

Exness operates legally in Pakistan through its Seychelles-registered entity, Exness (SC) Ltd, authorized by the Financial Services Authority (FSA) with license number SD025. The broker maintains compliance with local Pakistani financial regulations while providing CFD trading services to Pakistani traders. Pakistani residents can access Exness’s full range of trading instruments and platforms, including MetaTrader 4, MetaTrader 5, and the proprietary Exness Terminal. The company processes transactions in accordance with Pakistani foreign exchange regulations. Security measures include segregated client funds in tier-1 banks and PCI DSS certification for payment processing. Multiple regulatory licenses ensure Pakistani traders receive protected trading services.

Trading Features Available to Pakistani Traders:

- Market execution with speeds under 0.1 seconds

- Leverage options up to 1:Unlimited

- Zero commission on Standard accounts

- Stop Out Protection system

- Instant withdrawal processing

- Multi-language support including Urdu

Account Types for Pakistani Traders

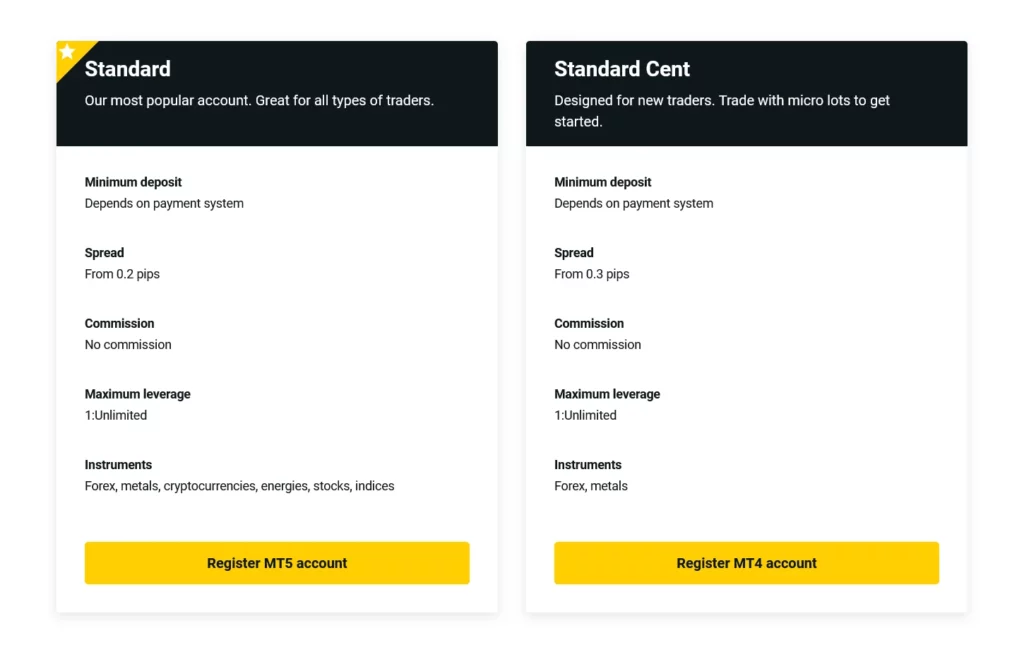

Pakistani traders can access multiple account types tailored to different trading styles and experience levels. Each account type offers specific advantages and trading conditions:

Standard Account Types:

| Feature | Standard | Standard Cent |

| Min. Deposit | $10 | $10 |

| Spread From | 0.2 pips | 0.3 pips |

| Commission | No | No |

| Max Leverage | 1:Unlimited | 1:Unlimited |

| Instruments | All | Forex, Metals |

Trading Platforms Accessibility

Pakistani traders receive access to multiple trading platforms optimized for different devices and trading preferences. MetaTrader 4 and MetaTrader 5 offer comprehensive technical analysis tools, with over 40 built-in indicators and customizable charts. The Exness Terminal provides web-based trading without downloads. Mobile applications enable trading through iOS and Android devices, maintaining full functionality of desktop versions.

MetaTrader 5 Features

- 38 built-in technical indicators

- 22 analytical objects

- 46 graphical tools

- 9 timeframes from M1 to MN

- Advanced pending orders

- Hedging capabilities

- Algorithmic trading support

Payment Methods for Pakistani Traders

Exness provides multiple payment options adapted to Pakistani banking systems and local preferences. Transactions process through secure payment gateways with instant processing for 95% of withdrawal requests.

Available Payment Methods in Pakistan:

| Method | Processing Time | Commission |

| Bank Transfer | 1-3 days | No fee |

| Credit Cards | Instant | No fee |

| E-wallets | Instant | No fee |

| Local Banks | Same day | No fee |

Trading Instruments Available

Pakistani traders can access diverse trading instruments across multiple asset classes. The platform offers over 200 trading instruments including major and minor currency pairs, precious metals, energies, and cryptocurrencies.

Forex Trading Conditions

- Major pairs spreads from 0.1 pips

- 107 currency pairs available

- Market execution under 0.1 seconds

- Customizable leverage settings

- Swap-free options available

- Stop Out Protection feature

- Real-time price feeds

Security Measures and Protection

Exness implements multiple security layers protecting Pakistani traders’ funds and personal information. Client funds remain segregated in tier-1 banks, ensuring separation from operational accounts. The platform maintains PCI DSS certification for payment security and conducts regular security audits.

Trading Tools and Analytics

| Tool Type | Features | Availability |

| Technical Analysis | 40+ indicators | All platforms |

| Economic Calendar | Real-time updates | Web/Mobile |

| Trading Signals | Professional feeds | MT4/MT5 |

| Market News | FXStreet integration | All accounts |

Customer Support for Pakistani Traders

Support services operate 24/7 with multi-language assistance including Urdu speakers. Pakistani traders can access support through multiple channels including live chat, email, and phone support. Response times average under 5 minutes for live chat inquiries.

Market Analysis Tools for Pakistani Traders

The platform provides Pakistani traders with advanced market analysis capabilities through integrated tools and third-party services. TradingView charts integration enables complex technical analysis with custom indicators and drawing tools. Real-time market data feeds ensure accurate price information across all trading instruments. Economic calendar updates display high-impact events affecting Pakistani trading hours. VPS hosting services maintain stable algorithmic trading operations with 99.9% uptime guarantee. Trading Central signals integrate directly into trading platforms, providing professional market analysis.

Technical Analysis Capabilities

- Custom indicator development

- Multiple chart types and timeframes

- Advanced pattern recognition

- Historical data access

- Correlation analysis tools

- Volume profile indicators

- Market depth information

Trading Account Management

Pakistani traders control account settings through intuitive management interfaces. Personal Area provides centralized account control with security features. Multiple account currencies support diverse trading strategies. Internal transfer systems enable efficient fund management between accounts.

Educational Resources

Pakistani traders gain access to educational materials supporting trading development. Resources include video tutorials, webinars, and market analysis in multiple languages including Urdu.

FAQ:

Pakistani traders must provide government-issued ID, proof of residence dated within 3 months, and complete verification procedures complying with KYC requirements.

Pakistani traders can use local bank accounts for deposits and withdrawals, with transactions processing through authorized payment channels complying with State Bank of Pakistan regulations.

Trading hours align with global market sessions, operating 24/5 for forex pairs and varying hours for other instruments, with server time GMT+3.